In today's fast-paced world, managing finances has become easier with the advent of digital payment solutions like Conns Payment. Whether you're making a purchase or settling monthly bills, understanding how Conns Payment works is essential for a seamless financial experience. This article will provide an in-depth look into Conns Payment, its benefits, and how it can simplify your financial transactions.

Conns Payment is more than just a payment method; it is a solution designed to cater to the needs of modern consumers. By offering flexibility and convenience, it has become a popular choice for individuals seeking efficient ways to manage their payments.

As we delve deeper into this topic, we will explore the intricacies of Conns Payment, its features, and the impact it has on both consumers and businesses. Whether you're new to Conns Payment or looking to enhance your understanding, this article will serve as a valuable resource.

Read also:Amanda Labollita Quincy Anonib Unveiling The Multifaceted Star

Table of Contents

- Introduction to Conns Payment

- How Conns Payment Works

- Benefits of Using Conns Payment

- Conns Payment Process

- Security Features of Conns Payment

- Conns Payment Fees

- Customer Support for Conns Payment

- Common Issues with Conns Payment

- Conns Payment and Financial Management

- Future of Conns Payment

Introduction to Conns Payment

Conns Payment is a financial service offered by Conns, a well-known retailer specializing in furniture, appliances, and electronics. The payment system allows customers to purchase items on credit and pay them off over time. This service is particularly beneficial for those who wish to acquire high-value items without paying the full amount upfront.

Conns Payment operates through a credit account that customers can use to make purchases at Conns stores or online. The account offers flexible payment options, including monthly installments, which cater to the financial needs of various customers.

Key Features of Conns Payment

- Flexible payment plans

- No down payment required

- Low interest rates

- Easy application process

How Conns Payment Works

Understanding the mechanics of Conns Payment is crucial for anyone considering this service. When you apply for a Conns Payment account, you will go through a credit evaluation process. Once approved, you can start using your account to make purchases at Conns stores or online.

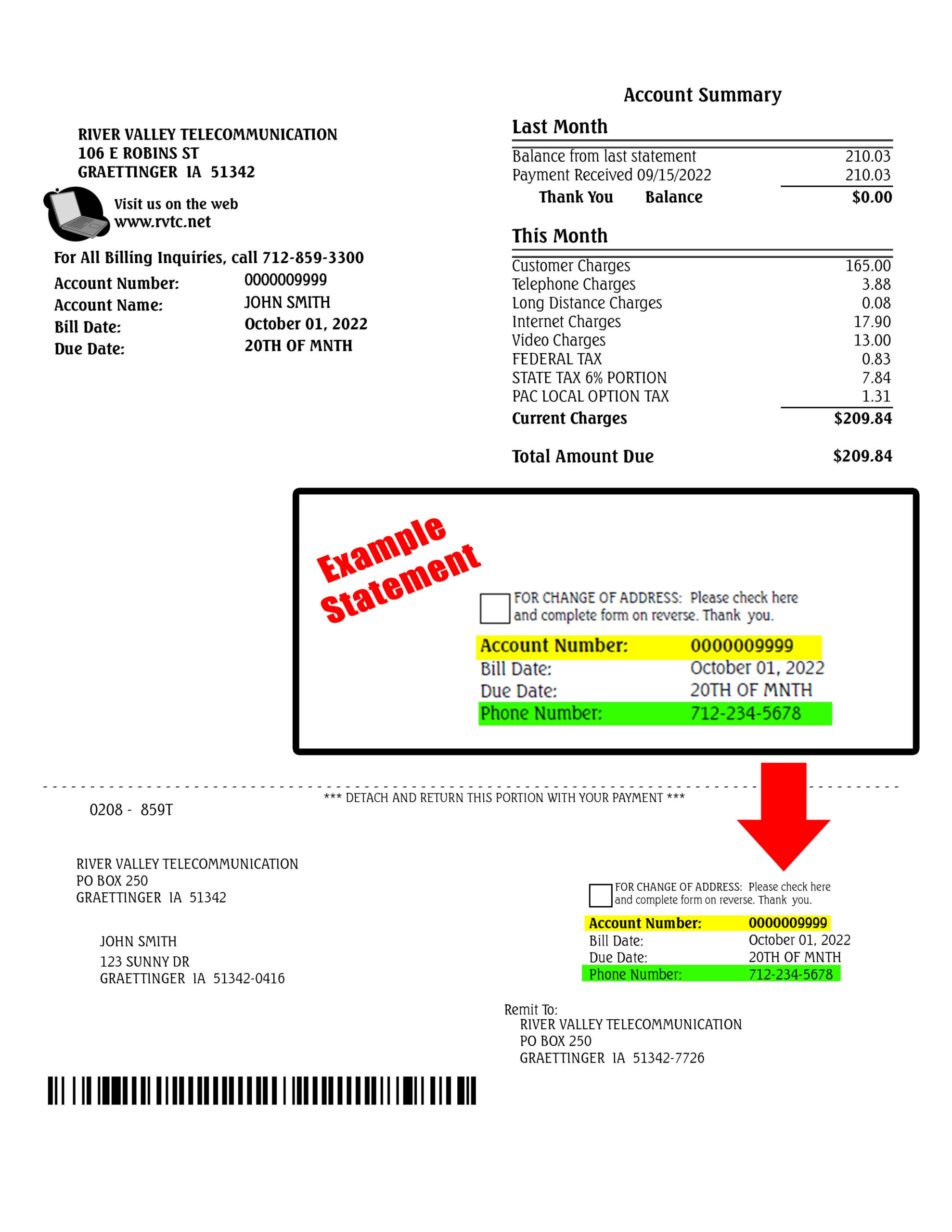

After making a purchase, you will receive a monthly bill detailing the amount due. You can choose to pay the minimum amount or the full balance, depending on your financial situation. The payment schedule is designed to accommodate different payment preferences, ensuring convenience for all users.

Steps to Use Conns Payment

- Apply for a Conns Payment account

- Get approved for credit

- Make purchases using your account

- Receive monthly billing statements

- Pay your bill on time

Benefits of Using Conns Payment

Conns Payment offers numerous advantages that make it an attractive option for many consumers. Below are some of the key benefits:

- Convenience: With Conns Payment, you can purchase items without needing to pay the full price upfront.

- Flexibility: Choose from various payment plans that suit your financial situation.

- Low Interest Rates: Enjoy competitive interest rates compared to other credit options.

- Build Credit: Consistently paying your Conns Payment account can help improve your credit score.

Conns Payment Process

The Conns Payment process is straightforward and user-friendly. Here's a step-by-step guide to help you navigate through the system:

Read also:Fitnessnala Leak Unveiling The Truth Behind The Controversy

- Application: Complete an online or in-store application for a Conns Payment account.

- Credit Approval: Wait for the credit evaluation process, which typically takes a few minutes.

- Shopping: Start shopping for items you wish to purchase using your Conns Payment account.

- Payment: Receive monthly billing statements and make timely payments to avoid late fees.

Payment Options

Conns Payment offers multiple payment options to suit your preferences:

- Online banking

- Mobile payments

- Phone payments

- In-store payments

Security Features of Conns Payment

Security is a top priority for Conns Payment, ensuring that all transactions are safe and protected. The system employs advanced encryption technology to safeguard your personal and financial information.

Additionally, Conns Payment offers fraud protection services to monitor your account for suspicious activities. If any unauthorized transactions occur, you can report them immediately to Conns customer support for resolution.

Best Practices for Secure Transactions

- Use strong passwords for your Conns Payment account

- Enable two-factor authentication

- Regularly review your billing statements for accuracy

- Report any suspicious activity promptly

Conns Payment Fees

While Conns Payment offers competitive interest rates, it's essential to be aware of the associated fees. These fees may include:

- Late Payment Fees: Charged if you miss a payment deadline.

- Overlimit Fees: Incurred if you exceed your credit limit.

- Returned Payment Fees: Applied if your payment is returned due to insufficient funds.

Understanding these fees can help you manage your Conns Payment account effectively and avoid unnecessary charges.

Customer Support for Conns Payment

Conns Payment provides excellent customer support to assist you with any questions or issues you may encounter. Their support team is available through various channels, including phone, email, and live chat.

In addition to customer support, Conns Payment offers a comprehensive FAQ section on their website, addressing common queries and providing helpful tips for managing your account.

Contact Information

- Phone: 1-877-923-3003

- Email: support@conns.com

- Website: www.conns.com

Common Issues with Conns Payment

Despite its many advantages, some users may encounter issues with Conns Payment. Common problems include:

- Difficulty logging into the account

- Discrepancies in billing statements

- High interest rates

- Technical difficulties during the payment process

If you face any of these issues, contact Conns customer support for assistance. They are equipped to resolve problems efficiently and ensure a smooth experience for all users.

Conns Payment and Financial Management

Using Conns Payment as part of your financial management strategy can be highly beneficial. By consistently paying your bills on time, you can improve your credit score and build a strong financial foundation.

However, it's important to use Conns Payment responsibly. Avoid overspending and ensure that you can meet your monthly payment obligations. This approach will help you maintain financial stability and avoid unnecessary debt.

Tips for Responsible Financial Management

- Create a budget to track your expenses

- Set up automatic payments to avoid late fees

- Review your credit report regularly

- Seek financial advice if needed

Future of Conns Payment

The future of Conns Payment looks promising as the company continues to innovate and expand its services. With advancements in technology, Conns Payment is likely to introduce new features that enhance the user experience and provide even more convenience for customers.

Additionally, Conns Payment may explore partnerships with other financial institutions to offer expanded services and benefits. Staying informed about these developments can help you take full advantage of the opportunities they present.

Predictions for Future Enhancements

- Integration with digital wallets

- Expanded payment options

- Enhanced fraud detection systems

- Improved mobile app functionality

Conclusion

In conclusion, Conns Payment offers a reliable and convenient solution for managing your financial transactions. By understanding how it works, its benefits, and the associated fees, you can make informed decisions about using this service.

We encourage you to take advantage of the resources provided in this article and explore the possibilities that Conns Payment has to offer. If you have any questions or feedback, please leave a comment below or share this article with others who may find it helpful. Together, let's build a stronger financial future!