Visa Vanilla Balance is a crucial aspect for anyone managing their finances through prepaid debit cards. Understanding how this balance works, its benefits, and potential drawbacks can help you make informed decisions about your financial tools. Whether you're a student, traveler, or small business owner, this guide will provide you with all the essential information you need to maximize your Visa Vanilla card usage.

In today's digital age, prepaid debit cards have become increasingly popular due to their flexibility and convenience. Among these, Visa Vanilla stands out as a reliable option for individuals seeking an alternative to traditional banking accounts. This card offers users the ability to load funds, track expenses, and make purchases both online and offline without requiring a bank account.

As we delve deeper into this article, you'll discover everything from how to check your Visa Vanilla balance, tips for maximizing its use, to troubleshooting common issues. Whether you're just starting out or looking to enhance your knowledge, this guide will serve as your ultimate resource for managing your Visa Vanilla card effectively.

Read also:Aiyuens Leak Unveiling The Truth Behind The Viral Phenomenon

Table of Contents

- Introduction to Visa Vanilla Balance

- How to Check Your Visa Vanilla Balance

- Benefits of Using Visa Vanilla Card

- Activating Your Visa Vanilla Card

- Loading Funds onto Your Card

- Security Features and Fraud Protection

- Maximizing Your Card Usage

- Understanding Fees Associated with the Card

- Troubleshooting Common Issues

- Conclusion and Final Tips

Introduction to Visa Vanilla Balance

What is Visa Vanilla Card?

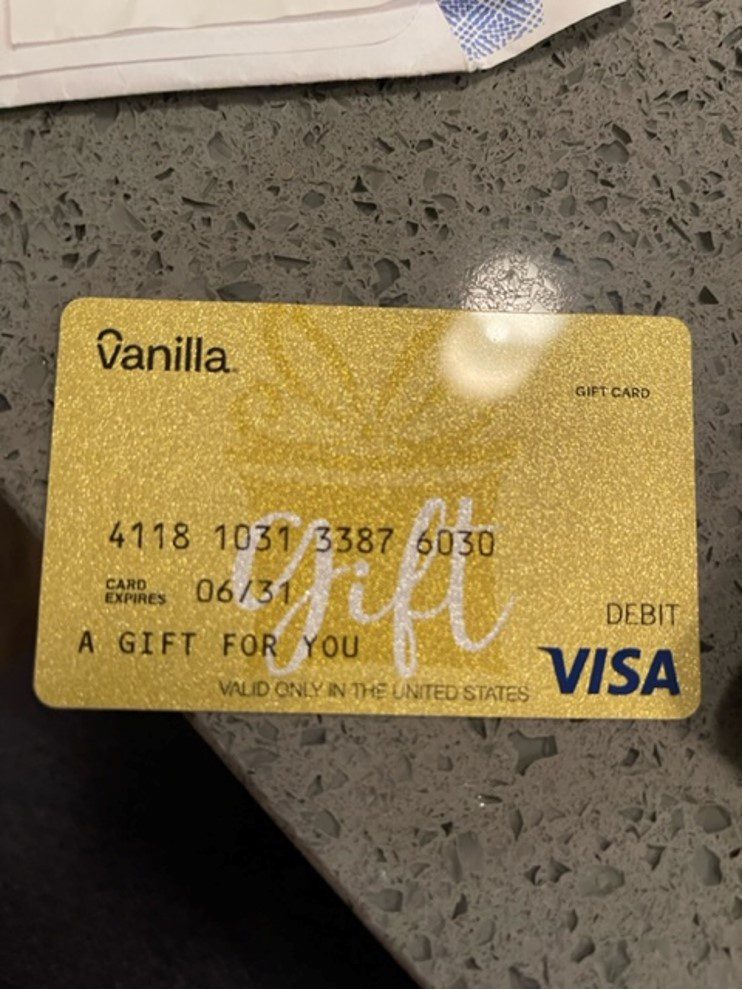

The Visa Vanilla card is a prepaid debit card that allows users to load funds and spend them like a traditional debit or credit card. Unlike credit cards, which involve borrowing money, or bank accounts, which require maintaining relationships with financial institutions, prepaid cards offer a straightforward way to manage finances. Your Visa Vanilla balance represents the amount of money available on the card for spending or withdrawals.

Why Choose Visa Vanilla?

This card is ideal for individuals who prefer not to use credit cards or maintain bank accounts. It provides flexibility for managing personal finances, especially for those who travel frequently or need a secure method of online transactions. Understanding your Visa Vanilla balance ensures you stay within budget and avoid overspending.

How to Check Your Visa Vanilla Balance

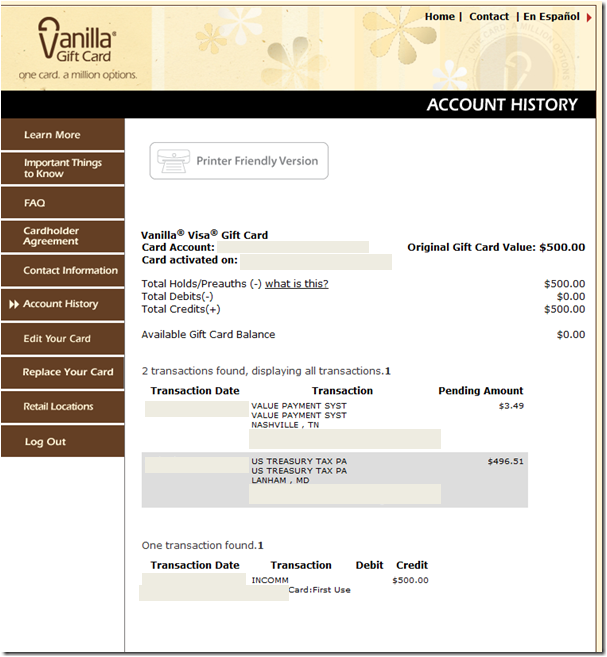

Checking Balance Online

To check your Visa Vanilla balance online, follow these simple steps:

- Visit the official website of the card issuer.

- Log in using your account credentials.

- Once logged in, navigate to the "Account Summary" section to view your current balance.

Checking Balance via SMS

For those who prefer mobile convenience, you can also check your Visa Vanilla balance by sending an SMS. Ensure that your mobile number is registered with the card issuer and follow their specific instructions for requesting balance updates via text.

Benefits of Using Visa Vanilla Card

Using a Visa Vanilla card offers numerous advantages, including:

- No Credit Check: Unlike credit cards, you don't need a credit check to obtain a Visa Vanilla card.

- Global Acceptance: As a Visa card, it is widely accepted in millions of locations worldwide.

- Expense Control: You can only spend what you load onto the card, helping you stay within budget.

Activating Your Visa Vanilla Card

Steps for Activation

Before using your Visa Vanilla card, activation is necessary. Here's how you can activate it:

Read also:Reemarie Ofleaks A Comprehensive Exploration Into Her Impact And Legacy

- Call the toll-free number provided on the card.

- Follow the prompts to enter your card number and other required details.

- Once activated, you can start loading funds and making purchases.

Loading Funds onto Your Card

Methods for Loading Funds

There are several ways to load funds onto your Visa Vanilla card:

- Online Transfers: Link your bank account to the card for seamless transfers.

- ATM Deposits: Use participating ATMs to add cash directly to your card.

- Retail Locations: Purchase reload cards from authorized retailers.

Security Features and Fraud Protection

Protecting Your Card

Visa Vanilla cards come equipped with robust security features, including:

- Zero Liability Policy: Protects you from unauthorized transactions if your card is lost or stolen.

- Two-Factor Authentication: Adds an extra layer of security when accessing your account online.

Maximizing Your Card Usage

Tips for Efficient Use

To get the most out of your Visa Vanilla card, consider the following tips:

- Regularly monitor your transactions to avoid unexpected fees.

- Plan your purchases to ensure you always have sufficient balance available.

- Take advantage of any promotional offers or cashback opportunities provided by the card issuer.

Understanding Fees Associated with the Card

Common Fees

While Visa Vanilla cards offer convenience, they may come with certain fees:

- Activation Fee: A one-time fee charged when activating your card.

- Monthly Maintenance Fee: Some issuers charge a fee if you don't meet specific usage criteria.

- ATM Withdrawal Fee: Charges applied for withdrawing cash from non-network ATMs.

Troubleshooting Common Issues

Solving Balance-Related Problems

If you encounter issues with your Visa Vanilla balance, here are some troubleshooting tips:

- Contact customer support immediately for assistance.

- Review recent transactions for any discrepancies or unauthorized charges.

- Ensure your card is activated and linked correctly to your funding source.

Conclusion and Final Tips

In conclusion, understanding and managing your Visa Vanilla balance is essential for maximizing the card's benefits. By following the tips and guidelines outlined in this article, you can enjoy secure, convenient, and cost-effective financial management. Remember to always stay informed about any updates or changes in card policies and fees.

We encourage you to share your experiences or ask questions in the comments below. Additionally, explore other articles on our site for more insights into personal finance management and prepaid card usage. Together, let's build a smarter financial future!

Data Source: Visa Official Website, Federal Trade Commission (FTC), and Consumer Financial Protection Bureau (CFPB).