In today's digital world, financial tools like the debit vanilla card have become essential for managing personal finances effectively. Whether you're looking for a prepaid card to control spending or a convenient alternative to traditional banking, the debit vanilla card offers a unique solution. This comprehensive guide will delve into everything you need to know about this versatile financial product.

The debit vanilla card is a prepaid card designed for individuals seeking flexibility in their financial transactions. Unlike traditional credit cards, it doesn't require a credit check or monthly bills. Instead, users load funds onto the card and use it for purchases, bill payments, and more. This makes it an attractive option for those who want to avoid debt while maintaining convenience.

As we explore this topic, we'll cover key aspects such as how the debit vanilla card works, its benefits, potential drawbacks, and tips for maximizing its use. Whether you're considering this card for personal use or as a gift, this article will provide valuable insights to help you make informed decisions.

Read also:Kueenkatia The Rising Star In The World Of Entertainment

Table of Contents

- What is a Debit Vanilla Card?

- How Does the Debit Vanilla Card Work?

- Benefits of Using a Debit Vanilla Card

- Potential Drawbacks

- Types of Debit Vanilla Cards

- Security Features

- How to Use the Debit Vanilla Card

- Comparison with Other Financial Products

- Costs and Fees

- Tips for Maximizing Usage

- Conclusion

What is a Debit Vanilla Card?

A debit vanilla card is a prepaid card that allows users to load funds and spend them as needed. Unlike credit cards, which rely on borrowed money, this card operates solely on the balance you load onto it. It's an excellent option for individuals who want to avoid debt while enjoying the convenience of card payments.

This type of card is widely accepted at merchants worldwide and can be used for online and in-store transactions. Additionally, it supports ATM withdrawals, making it versatile for various financial needs.

Key Features

- No credit checks required

- Preloaded funds for controlled spending

- Accepted globally with major payment networks

How Does the Debit Vanilla Card Work?

The debit vanilla card functions similarly to traditional debit or credit cards but operates on a prepaid basis. Users must load funds onto the card before using it for purchases or withdrawals. Once the balance is depleted, the card cannot be used until it's reloaded.

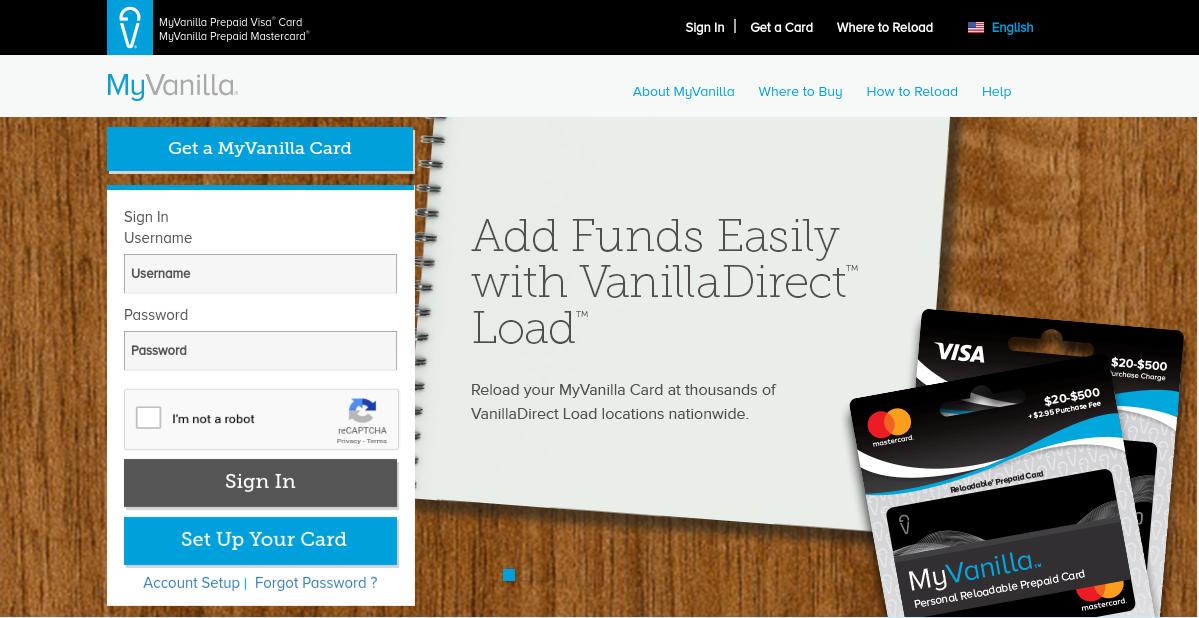

These cards are often issued by major payment networks like Visa or Mastercard, ensuring widespread acceptance. They can be purchased at retail stores, online platforms, or directly from financial institutions.

Steps to Use

- Purchase the card from an authorized retailer

- Activate the card by following the instructions provided

- Load funds onto the card using cash, bank transfers, or other supported methods

- Use the card for purchases, bill payments, or ATM withdrawals

Benefits of Using a Debit Vanilla Card

The debit vanilla card offers numerous advantages that make it a popular choice among consumers. Below are some of the key benefits:

- Debt-Free Spending: Since the card operates on preloaded funds, users avoid accumulating debt.

- Financial Control: It helps individuals manage their spending by limiting transactions to the available balance.

- Convenience: Accepted globally, the card provides flexibility for both online and offline transactions.

- No Credit Checks: Ideal for those with limited or poor credit history, as no credit checks are required.

According to a study by the Federal Reserve, prepaid cards like the debit vanilla card are increasingly popular among younger generations who prefer cashless transactions without the risks associated with credit cards.

Read also:Amanda Labollita Quincy Addressing The Nsfw Leak Scandal And Its Impact

Potential Drawbacks

While the debit vanilla card offers many advantages, it's essential to consider potential drawbacks:

- Fees: Some cards may charge activation, reload, or maintenance fees, which can add up over time.

- Limited Features: Unlike traditional bank accounts, these cards may not offer features like overdraft protection or interest on balances.

- Security Concerns: If the card is lost or stolen, recovering funds may be challenging, especially if the card isn't registered.

However, many issuers are improving security measures and customer support to address these concerns.

Types of Debit Vanilla Cards

1. Standard Prepaid Cards

These cards are designed for everyday use and are often sold at retail stores. They are simple to use and suitable for basic financial transactions.

2. Reloadable Cards

Reloadable debit vanilla cards allow users to add funds multiple times, making them ideal for recurring use. They often come with additional features like mobile apps for balance tracking.

3. Gift Cards

Some debit vanilla cards are marketed as gift cards, preloaded with a specific amount for gifting purposes. These cards are popular during holidays and special occasions.

Security Features

Security is a critical aspect of using any financial product, and the debit vanilla card is no exception. Modern cards come equipped with various security features to protect users:

- Chip and PIN Technology: Enhances security by requiring a PIN for transactions.

- Fraud Protection: Many issuers offer fraud protection services to safeguard against unauthorized use.

- Mobile Alerts: Users can receive notifications for transactions, helping them monitor card activity.

For instance, Visa's Zero Liability Policy ensures that cardholders are not held responsible for unauthorized transactions, adding an extra layer of security.

How to Use the Debit Vanilla Card

Using a debit vanilla card is straightforward, but understanding its full potential requires some guidance:

- Activate the Card: Follow the instructions provided to activate the card before use.

- Load Funds: Use supported methods to load funds onto the card. Options may include cash reloads, bank transfers, or online payments.

- Track Transactions: Utilize mobile apps or online portals to monitor spending and manage the card effectively.

For optimal usage, consider setting spending limits and regularly checking the card balance to avoid overspending.

Comparison with Other Financial Products

While the debit vanilla card offers unique advantages, it's helpful to compare it with other financial products:

- Credit Cards: Credit cards allow borrowing, but they come with interest charges and potential debt accumulation.

- Traditional Debit Cards: Linked to bank accounts, these cards require a formal banking relationship and may involve fees.

- Cash: While cash is widely accepted, it lacks the convenience and security of digital payment methods.

According to a report by the Pew Research Center, prepaid cards like the debit vanilla card are gaining traction as consumers seek alternatives to traditional banking.

Costs and Fees

Understanding the costs associated with the debit vanilla card is crucial for maximizing its value:

- Activation Fees: Some cards charge a one-time fee upon purchase.

- Reload Fees: Adding funds to the card may incur a small fee, depending on the method used.

- Maintenance Fees: Monthly or annual fees may apply, but many cards offer ways to waive these charges.

It's advisable to compare fees across different issuers to find the most cost-effective option.

Tips for Maximizing Usage

To get the most out of your debit vanilla card, consider the following tips:

- Choose the Right Card: Select a card that aligns with your financial needs and offers favorable terms.

- Monitor Transactions: Regularly check your card activity to ensure accuracy and security.

- Take Advantage of Promotions: Some issuers offer bonuses or rewards for specific activities, such as reloading funds.

By following these tips, you can enhance your experience and make the most of your debit vanilla card.

Conclusion

The debit vanilla card is a versatile financial tool that offers convenience, control, and security for users. Whether you're looking to manage personal finances, avoid debt, or gift someone a prepaid card, this product provides a practical solution. While it has its drawbacks, such as fees and limited features, its benefits often outweigh these concerns for many consumers.

We encourage you to explore the options available and choose a card that best suits your needs. Don't forget to share your thoughts or experiences in the comments below, and consider exploring other articles on our site for more insights into personal finance and financial tools.